Most drivers in Tennessee don't need SR22 insurance, but if you've had a serious traffic violation, you'll likely require it. You're probably wondering what SR22 insurance is and how it affects you.

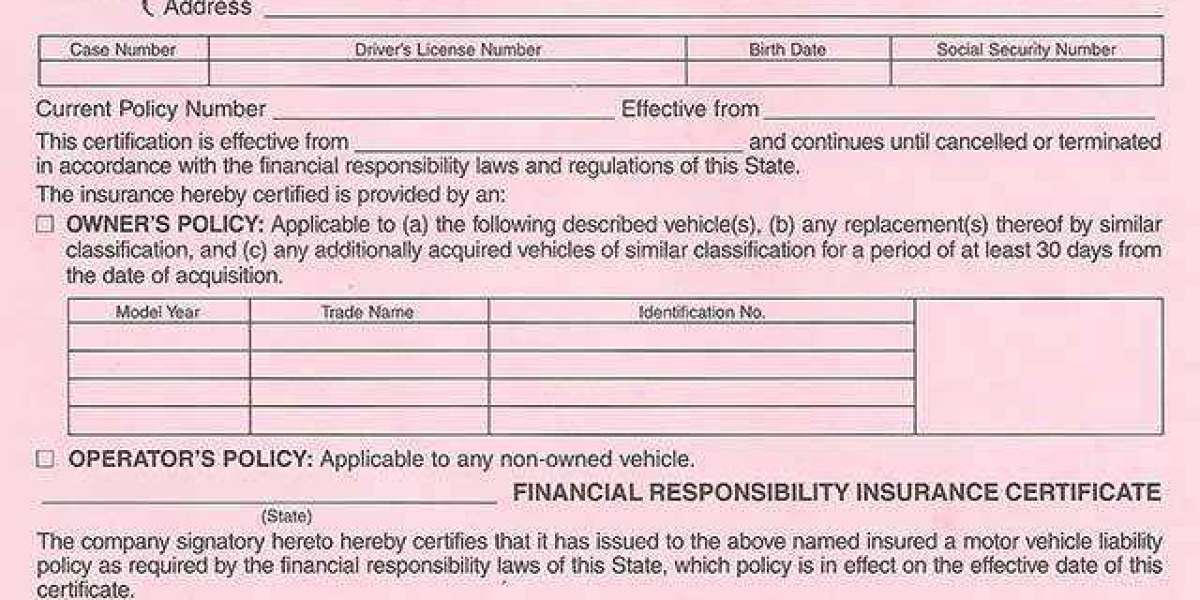

Most drivers in Tennessee don't need SR22 insurance, but if you've had a serious traffic violation, you'll likely require it. You're probably wondering what SR22 insurance is and how it affects you. The SR22 definition is a certificate of financial responsibility that proves you have the minimum required insurance coverage (licensed). It's not a type of insurance itself, but rather a filing that's added to your existing poli

You can't cancel an SR22 policy without notifying the state, you're dropping SR22 insurance options, potentially risking license suspension, so review SR22 policy cancellation rules carefully before proceedin

Shop around: Compare rates from different insurance providers to find the best deal.

Bundle policies: Combine your SR22 insurance with other policies to qualify for discounts.

Improve your driving record: Avoid accidents and traffic violations to lower your insurance rates.

Increase your deductible: Paying a higher deductible can lead to lower premium costs. By implementing these strategies, you can reduce your SR22 insurance costs and stay safe on the road. Remember to review your policy regularly to verify you're getting the best coverage at the best price.

- SR22 Insurance Agency Tennessee

Frequently Asked Questio

Your driving record, including any accidents or tickets, will impact your SR22 insurance costs

The type and value of your vehicle will also affect your rates

Your age, location, and other personal factors will be taken into account when determining your SR22 insurance costs

(

SR22 auto insurance in TN)You should understand that SR22 insurance is usually more expensive than standard auto insurance, but it's a necessary step to regain your driving privileges. SR22 auto insurance in TN. By assessing these cost factors, you can make informed decisions about your SR22 insurance and guarantee you're getting the best rates possible. You'll need to balance the costs with the need for safety and coverage on the ro

You should familiarize yourself with Tennessee's state insurance requirements, which include liability coverage for bodily injury and property damage. The state sets specific limits for these coverages, and you must meet or exceed them to comply with Tennessee regulations. By understanding and following these laws, you can confirm you're maintaining the necessary state insurance coverage and avoiding any potential penalties or fines. It's crucial to work with an insurance provider that's knowledgeable about Tennessee regulations and can help you manage the process of obtaining cheap SR22 insurance options that meet the state's requirement

You've completed the

SR22 insurance TN filing process, and now it's time to contemplate the financial implications of SR22 insurance. SR22 insurance cost in TN in Tennessee. You'll need to evaluate the costs associated with SR22 insurance quotes and the various sr22 policy types availab

When it comes to SR22 insurance in Tennessee, you're likely to find that the requirements are stringent, and it's essential you understand them. You'll need to file SR22 forms with the state, which certifies that you have the required insurance coverage. This filing is usually required after a Driving Under the Influence (DUI) conviction, reckless driving, or other serious offense

You'll save big on SR22 insurance in TN by understanding the laws and options. Curiously, 22% of drivers who need SR22 insurance don't get it, risking license suspension. licensed. You can avoid this by filing correctly and comparing high-risk insurance quotes to minimize premiums and stay compliant with Tennessee's regulatio

To comply with Tennessee's driving regulations, you'll need to understand SR22 requirements, which are typically mandated by the state after a driving offense. It's important to separate fact from fiction, as SR22 misconceptions can lead to confusion and unnecessary stress. You'll need to file an SR22 form with the Tennessee Department of Motor Vehicles, which certifies that you have the required insurance coverag

Can you drive others' cars with SR22? You're checking SR22 restrictions, so you'll follow driving regulations, ensuring safety with your SR22 insurance coverage on other vehicles you operate. (license

When you're labeled as a high-risk driver, finding affordable insurance can be challenging, but you have options. You can investigate different insurance providers that specialize in high-risk insurance. licensed. These providers offer various plans and rates, so it's crucial to compare them to find the best fit for y

Several insurers offer SR22 insurance in Tennessee, and you'll likely find varying rates and coverage options among them. You should research and compare different insurance policy types to find the one that suits your needs. This comparison will help you identify the most affordable option with the necessary coverag

If you're required to have SR22 insurance, you'll need to understand the SR22 benefits. One of the main benefits is that it allows you to maintain your driving privileges after a serious traffic violation. It also provides proof of insurance to the state, which can help prevent your license from being suspended. Additionally, having SR22 insurance can help you avoid further penalties and fines. By understanding what

SR22 insurance TN insurance is and how it works, you can guarantee you're meeting the necessary requirements to stay safe on the road. This knowledge will help you maneuver the process and make informed decisions about your insurance coverag

If you have any concerns with regards to wherever and how to use

click here now, you can get in touch with us at our web-site.

เทคนิคการวิเคราะห์สำหรับนักเดิมพันฟุตบอลมือใหม่

By Using the Power Of Vibrations

By Using the Power Of Vibrations

Interactive Slots Tools To Streamline Your Everyday Lifethe Only Interactive Slots Trick That Everyone Should Learn

By rainbet6688

Interactive Slots Tools To Streamline Your Everyday Lifethe Only Interactive Slots Trick That Everyone Should Learn

By rainbet6688 11 Ways To Completely Redesign Your Private Psychiatrist Glasgow

11 Ways To Completely Redesign Your Private Psychiatrist Glasgow

By Harnessing the Power Of Vibrations

By Harnessing the Power Of Vibrations